My Journey into Product-Market Fit (PMF)

Fresh out of university, I stumbled into the startup world through an internship. When the founder launched a new venture, I jumped aboard. This decision would teach me invaluable lessons about PMF.

In those early days, I wore many hats—from marketing to operations, before finding my calling in product management. Our first mistake? We focused only on a small group of super users who shaped our product’s direction. Their unique behaviour patterns didn’t align with our broader user base, making it challenging to scale our core proposition to generate revenue. In this previous blog post, I talked about failing to change the direction of the product through user research. That feature did not do well.

I didn’t know the term at the time but I was trying to find PMF.

Understanding Product-Market Fit

Marc Andreessen defines PMF as “being in a good market with a product that can satisfy that market.” Simple in theory, yet elusive in practice—after all, 90% of startups fail. But don’t let that statistic discourage you. Let’s explore practical methods to measure PMF.

Proven Methods to Measure PMF

1. The Sean Ellis Test

This method offers a straightforward approach to measuring PMF.

Here’s how to do it:

- Survey at least 40 customers who have experienced the core of your product offering.

- Ask them: "How would you feel if you could no longer use [your product name]?".

- Give three options: Very disappointed, Somewhat disappointed, Not disappointed.

It’s a strong sign you have not achieved product-market fit if over 40% of respondents say they would be “very disappointed”.

The standout example using this technique? Rahul Vohra, Superhuman’s founder, transformed this test into a science. Here’s the questions he asked his users:

- How would you feel if you could no longer use Superhuman? Options: Very disappointed, Somewhat disappointed and Not disappointed.

- What type of people do you think would most benefit from Superhuman?

- What is the main benefit you receive from Superhuman?

- How can we improve Superhuman for you?

Case study: Superhuman’s journey

- At the start, they scored low. Despite this, they persisted with experimentation. They focused only on “very disappointed” users.

- Next, he looked at creating personas in the ‘very disappointed’ group. Using Julie Supan’s high-expectation customer framework, Rahul focused on the high-expectation customer (HXC). To find this group, he analysed their responses to the second question in their survey: “What type of people do you think would most benefit from Superhuman?”. Some people may disagree with this approach. Paul Graham articulates why it makes sense to focus on this group in this post.

- They focused on the third question in the survey: “What is the main benefit you receive from Superhuman?”. Rahul was trying to understand what they love about the product. This laser focus meant that Rahul was not building ‘distracting features’.

- Finally, they focused on the last question in the survey: “How can we improve Superhuman for you?”. This helped Rahul to identify what was holding back his key users.

- Rahul came to a realisation that he couldn’t focus on building only what users love. The roadmap now covers what is holding his users back too (a 50/50 split).

The results were remarkable. Investors began competing to invest, and users became vocal advocates on social media.

“If you only double down on what users love, your product-market fit score won’t increase. If you only address what holds users back, your competition will likely overtake you.” - Rahul Vodhra

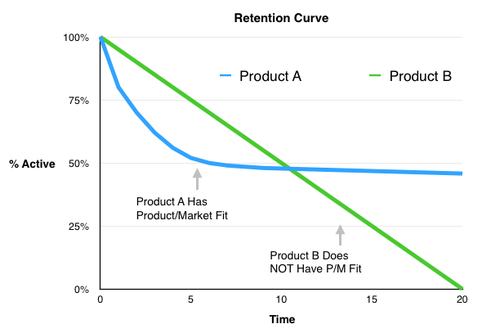

2. Retention Curve Analysis

This method visualises user engagement over time. A successful retention curve resembles a smile—initial drop-off followed by stabilisation.

- Plot the percentage of users still active after X days/weeks/months.

- Look for the curve to flatten out, indicating a core group of users finding ongoing value.

‘Retention Curve Analysis’ an image by Brian Balfour: https://brianbalfour.com/essays/product-market-fit

‘Retention Curve Analysis’ an image by Brian Balfour: https://brianbalfour.com/essays/product-market-fit

If you observe, the percentage of active users declining without stabilising, it means you don’t have PMF. For example, Product A sees a drop in active users during the first month, but usage then stabilises over the next two months – this indicates PMF. In contrast, Product B experiences a steady decline in active users across all three months, showing it lacks PMF.

Case study: Discord’s early retention curves showed remarkable stability among gaming communities. After an initial drop-off, they maintained steady usage among core gaming servers, indicating strong PMF.

3. Net Promoter Score (NPS) and Customer Engagement Score (CES)

NPS measures customer loyalty and the likelihood of people recommending your product. Here’s how to calculate it:

- Ask customers: "On a scale of 0-10, how likely are you to recommend [product] to a friend or colleague?"

- Based off those responses, you can categorise responses: 9-10 (Promoters), 7-8 (Passives) and 0-6 (Detractors)

- Calculate NPS = % Promoters - % Detractors

While there’s no universal NPS threshold for PMF, high scores (50+) are a good indicator. NPS isn’t perfect though. Other metrics in combination with NPS can help to determine PMF.

Leah Tharin, a Product Leader, makes the case for using Customer Engagement Score. Ask your users right after they used a tool “How easy was this for you?” on a scale of 1-5. After they use a specific feature, you can learn what to do to improve. Leah’s point is that the NPS score can be generic. People can love your products but not everything about it. The NPS can mask learning deeper insights.

Case study: Notion implemented feature-specific CES surveys, leading to targeted improvements in their template system. This helped them evolve from a basic note-taking app to a comprehensive workplace tool.

4. Cohort Analysis

Tracking user groups over time can reveal whether product improvements are working. For example you could explore the feature usage rate. This measures how well your product addresses user problems and meets their needs. It’s calculated by dividing the number of users who use a specific feature by the total number of users over a given period. A high feature usage rate indicates your product is delivering value and engaging users with its core function. A low usage rate suggests the product isn’t solving user issues or may be too complex or unclear.

Case study: Spotify’s Discover Weekly feature underwent extensive cohort analysis. Early cohorts showed moderate engagement. Continuous refinement based on cohort data led to the feature becoming one of their most successful retention tools.

5. Lifetime Value:Customer Acquisition Cost Ratio (LTV:CAC)

Understanding your LTV:CAC ratio is a valuable way to assess PMF. It shows if you’re not only gaining customers but also doing it profitably.

First, pinpoint what makes someone a true customer. In the subscription world, this might be someone who’s stuck around for at least a month.

Let’s break down the maths. Your Lifetime Value (LTV) calculation is:

LTV = Average Purchase Value × Average Number of Purchases × Average Customer Lifespan

For Customer Acquisition Cost (CAC), combine your marketing spend and sales costs, then divide by new customers gained:

CAC = (Sales Costs + Marketing Spend) ÷ New Customers

Aim for an LTV:CAC ratio of at least 3:1. Hit this, and you’ve got solid evidence of PMF. Imagine spending £1 to get a customer who brings in £3—that makes businesses thrive.

Case study: Zoom achieved remarkable LTV:CAC ratios during their growth phase, with enterprise customers showing ratios exceeding 5:1. This indicated strong PMF in the business segment.

6. Total addressable market (TAM)

Imagine your product as a ship and TAM as your ocean—you need to know if there are enough fish to make your voyage worthwhile. But how big is your ocean? There are three ways to map your market’s true size:

The Bird’s Eye View (Top-Down)

Start with reliable data from official sources, like government statistics. I read official reports by Think Tanks or use Statista to learn more about the size of a market. Think of it as satellite imagery of your market—you’ll see the big picture, but might miss some detail. For instance, if you’re launching a luxury watch brand, you’d look at national spending on premium timepieces.

The Detective’s Approach (Bottom-Up)

This method is like piecing together a puzzle using real sales data and pricing patterns. It’s more precise but requires more legwork. A luxury watchmaker might analyse sales figures from existing brands, price points, and sale patterns to build a detailed picture of the market.

The Value Navigator (Value Theory)

Ask yourself: “What makes our product special, and how much would people pay for that uniqueness?”. If your smart watch helps people sleep better than competitors’ devices, how much extra would customers spend for a good night’s rest? This approach helps you spot untapped market opportunities.

Understanding your TAM helps you fine-tune your product and business model to capture a bigger slice of the pie. Earlier in the blog post, I talked about not having a large enough market in the group we focused on. Knowing our TAM could have helped us work out where to focus our attention.

‘Market stall’ an image by Quintin Gellar: https://www.pexels.com/photo/man-in-blue-top-giving-box-to-man-in-gray-top-696205/

‘Market stall’ an image by Quintin Gellar: https://www.pexels.com/photo/man-in-blue-top-giving-box-to-man-in-gray-top-696205/

7. Obtainable market

To calculate your obtainable market, you need to focus on what you can achieve within your current resources and conditions. Even a giant like Apple doesn’t control the entire smartphone market, and that’s fine. The key is understanding how much of the market you need to capture to build a thriving business. Start by narrowing down your playing field.

For example, if you’re launching a boutique tea shop, your total addressable market (TAM) isn’t every tea drinker in Britain—it’s the tea enthusiasts within a reasonable distance of your shop. This is your battleground. From here, you’ll need to refine your target based on practical constraints:

- Marketing Budget: How much can you invest in reaching potential customers?

- Competition: Who are your competitors, and how well-established are they?

- Economic Climate: Is the current environment helping or hindering consumer spending?

This gives you your Serviceable Obtainable Market (SOM)—a part of the market you can capture. Think of it as your first mountain to climb, not the entire range. While your SOM may seem like an educated guess, it’s a much more valuable target than chasing the entire market.

As your business grows, your obtainable market expands. Imagine, that tea shop evolves into a northern chain, then becomes a national brand. Your SOM grows as your capabilities do, with a larger marketing budget, a stronger sales team, and broader brand recognition helping you secure a bigger piece of the pie.

Break this down further:

- If your TAM is £1 billion, your SAM (based on geography or a niche market) might be £200 million.

- After considering your marketing reach, sales capabilities, and competition, your SOM could be 10% of that SAM, or £20 million.

8. Growth and profit

The “Rule of 40” is a benchmark that suggests your growth rate plus profit margin should hit at least 40% to prove you’ve met PMF. Think of it as your business’s fitness score—are you running fast enough while maintaining enough energy reserves?

In your early days, you’re like a sprinter out of the blocks—expect explosive growth rates. Imagine Slack in its early years, spreading like wildfire through tech companies. If you’re not seeing this initial burst of speed, it might be time to question if you’ve found your PMF. As you mature, you’re more like a marathon runner.

Case study: Take Microsoft—they’re not doubling in size anymore, but they’re consistent. Their impressive profit margins more than make up for slower growth, keeping them well above that magic 40% mark.

Don’t panic if your young company’s profit margins look slim—you might be in experimentation mode.

Case study: Zoom, for instance, focused on rapid growth, fine-tuning their pricing and optimising costs only after capturing a significant market share.

The key is knowing which metric deserves your attention at each stage of your journey.

You’re likely achieving PMF when you see:

- Organic growth through word-of-mouth

- High retention rates and engagement

- Users expressing genuine disappointment at the thought of losing your product

- Sustainable customer acquisition costs

- Meaningful feature usage rates

The Path Forward

Remember, PMF is not an exact science. These aren’t the only metrics to measure PMF. Don’t forget to use qualitative data too. Airbnb’s Brian Chesky stayed with hosts to gain deep insights into their needs and pain points. Remember, PMF isn’t a destination but a journey of continuous refinement. As markets evolve and user needs shift, your product must adapt.

Your journey to PMF might not mirror Superhuman’s or Airbnb’s, but by employing these measurement techniques and maintaining user-centricity, you’ll be well-equipped to navigate the path to product-market fit.